What is PancakeSwap?

CAKE is a governance token issued by a decentralized exchange PancakeSwap, which is an automatic market maker also called AMM. Many people call it a clone of Uniswap with one exception only. It works on Binance Smart Chain (BSC), which is Binance own blockchain. The facility enables the trading of BEP-20 tokens for users who can also earn rewards providing the liquidity for the exchange.

There is a possibility of farming the governance token of the platform CAKE. Depositing LP (Liquidity Provider) tokens, customers lock their assets for rewards. There are a lot of tokens that can be deposited for this goal such as BNB LP (Cake or BUSD), ETH LP (BETH), and others.

The aims targeted by PancakeSwap

The team of the platform pursued several goals during the development and one of them was to overtake such decentralized projects as SushiSwap and Uniswap. The team introduced interesting developments combining non-fungible tokens (NFT) with swaps, lending, and UI customization. Special attention was paid to such aspects as speed, low fees, and 3-digit API. Thanks to the efforts of developers, the token has acquired the top position in the DeFi rankings on Binance Smart Chain. Thus, the goal has been partially achieved. The choice of BSC above Ethereum is explained by the speed and lower fees provided by BSC which turn out to be really ponderable benefits and help to attract more users.

Though the assortment of products is good, the roadmap includes the development of more services on the platform including lending and borrowing, binary options, margin trading, and NFT-based gamification.

PancakeSwap platform

At first sight, this is just another food-themed DeFi protocol that resembles SushiSwap in such features as community governance and the capability of farming liquidity provider tokens. However, besides that, the platform introduced numerous features for the members of the community that allow them to earn higher rewards. The funds can be staked in DeFi protocol in return for its tokens in the same way as in other DeFi projects. Most of them are found on the Ethereum blockchain, which was the first that incorporated the support of smart contracts.

The platform gives the possibility of trading digital assets without an order book. It means that customers are not matched with each other trading against a liquidity pool that includes funds of other members of the community who invested in the pool. After depositing, users get liquidity provider tokens (LP tokens) that can be used to reclaim a share with a part of the trading fees.

The platform with improved UX employs an easy-to-use navigation system. The members of the community can use a convenient personal dashboard that is customized to their taste. It is also worth mentioning the mobile-friendliness of the service.

The platform is actively inviting other projects to participate in the Syrup Pool. Such projects as OpenDAO, DODO, Swinby, Berrym, Compound, ZeroSwap, and many more have contributed their tokens to the pool by the time of writing. Users can earn the tokens of these projects in the same way by staking CAKE.

The platform arranges lottery sessions that take part every 6 hours. The customers should purchase tickets to participate. After its purchase, the person gets a random 4-digit combination of numbers from 1 to 14. The winner is a user with a combination of figures that match all numbers in the same position as in the ticket. In this case, 50% of the lottery pool is given to the winner.

PancakeSwap includes the exchange section, the pools section, and the farming section. Customers should provide liquidity to farm the CAKE token. It is necessary to have some Binance Coin to stake CAKE. The farming section offers pools with different rewards. Thus, the members of the community who provide the liquidity get 0.17% of all transaction fees and also earn FLIP tokens they can stake afterwards.

PancakeSwap security

Being aware of the safety problem faced by many decentralized exchanges the company applied to a reputable expert company, which was invited to audit the code. The CertiK’s audition conducted in October 2020 added one more advantage to the list of the platform’s features.

PancakeSwap tokens

CAKE can be staked in SYRUP pools. There are also FLIP tokens on the platform, which are liquidity provider tokens. They are used for farming CAKE and SYRUP tokens. The LP tokens should be locked for you to get the reward. However, when CAKE tokens are staked by customers, SYRUP tokens can be received, which have extended functionality and can be used as governance tokens. They also serve as tickets in lotteries.

CAKE token

The native token is CAKE, which has grown by 6000% in only 5 months since the release date. The growth of its price also affected the price of BNB, a native token of the Binance ecosystem.

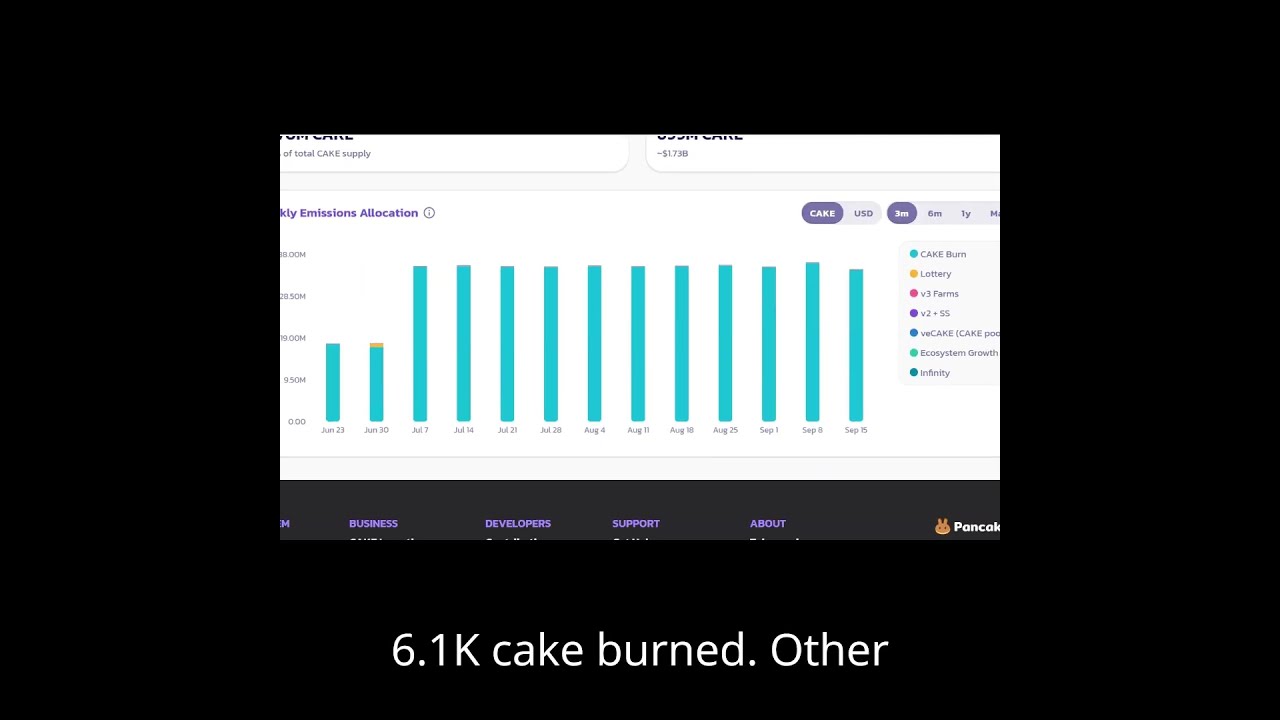

The burning system is rather complicated. The issuance of CAKE tokens is rebalanced by their redistribution in the farms, in the lottery, in the pools for staking, and the Initial Farm Offering. There are different percentages in each sector, which are sent to a blind address for burning. The aim is to keep the balance of supply.

Many features become accessible for users after they unlock the wallet. There are a few options offered to customers such as Trust Wallet, Binance Chain Wallet, Wallet Connect, and others. MetaMask can also be found in the list as the BSC architecture enabled its interaction with dApps of its blockchain.

PancakeSwap fees

During the token swap on the exchange, customers pay a 0.2% trading fee, 0.03% of which is sent to the PancakeSwap Treasury, while the rest is returned to the liquidity pools to pay rewards to the liquidity providers.

PancakeSwap team

The platform was developed by an anonymous team that launched the facility at the end of September 2020. However, it is known that the project was financed by CZ Zhao, the founder, and CEO of a leading cryptocurrency exchange Binance.

Click here to start mining PancakeSwap.

Latest PancakeSwap (CAKE) Videos

Latest PancakeSwap (CAKE) News